Kotak Mahindra Bank Ltd

NSE :KOTAKBANK BSE :500247 Sector : BanksBuy, Sell or Hold KOTAKBANK? Ask The Analyst

BSE

Apr 22, 00:00

2267.55

25.00 (1.11%)

prev close

2242.55

OPEN PRICE

2256.55

volume

150613

Today's low / high

2247.65 / 2301.55

52 WK low / high

1544.15 / 2301.55

bid price (qty)

0 (0)

offer price (qty)

0 (0)

NSE

prev close

open price

volume

Today's' low / high

52 WK low / high

bid price (qty)

offer price (qty)

| 22 Apr 2268.80 (1.22%) | 21 Apr 2241.40 (2.44%) | 17 Apr 2188.10 (3.05%) | 16 Apr 2123.40 (0.15%) | 15 Apr 2120.20 (0.43%) | 11 Apr 2111.20 (2.85%) | 09 Apr 2052.70 (-0.12%) | 08 Apr 2055.15 (0.85%) | 07 Apr 2037.85 (-4.41%) | 04 Apr 2131.95 (-0.03%) | 03 Apr 2132.60 (-1.02%) | 02 Apr 2154.60 (0.41%) | 01 Apr 2145.90 (-1.17%) | 28 Mar 2171.20 (2.00%) | 27 Mar 2128.65 (-0.76%) | 26 Mar 2144.90 (-1.16%) | 25 Mar 2170.00 (-0.28%) | 24 Mar 2176.15 (4.67%) | 21 Mar 2079.00 (2.13%) | 20 Mar 2035.65 (0.70%) | 19 Mar 2021.55 (-0.61%) |

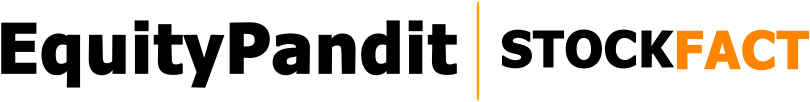

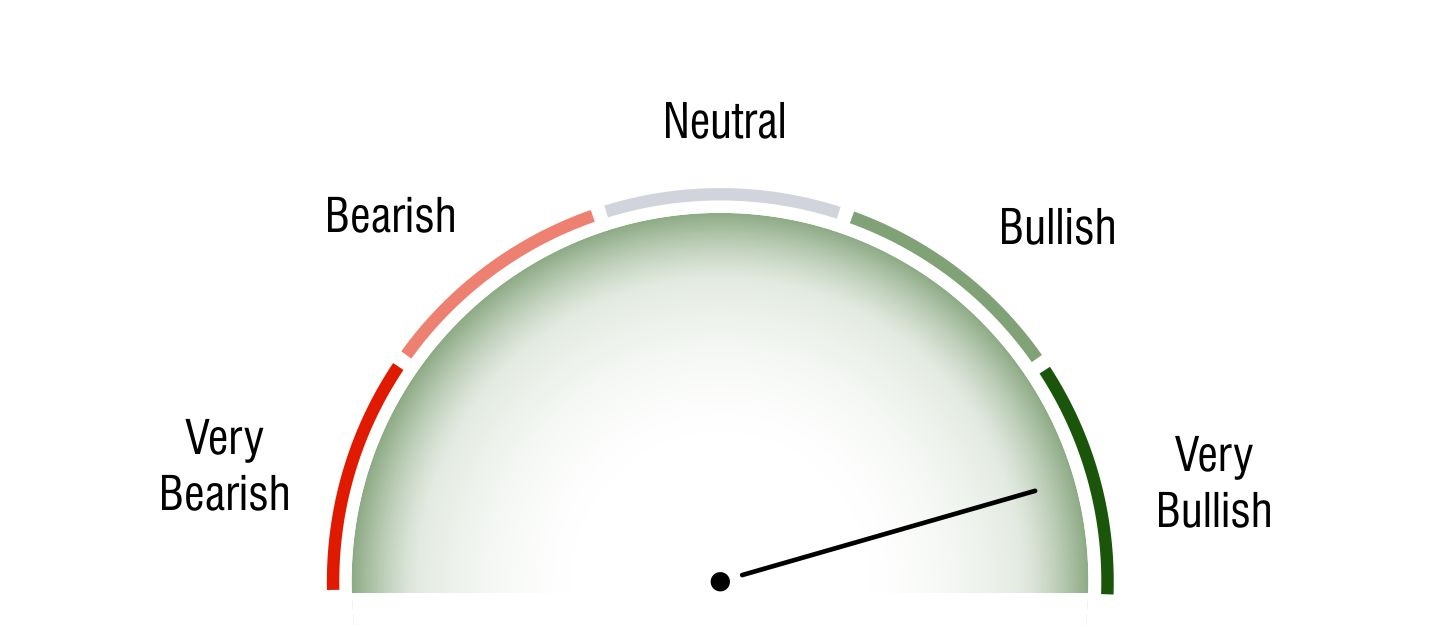

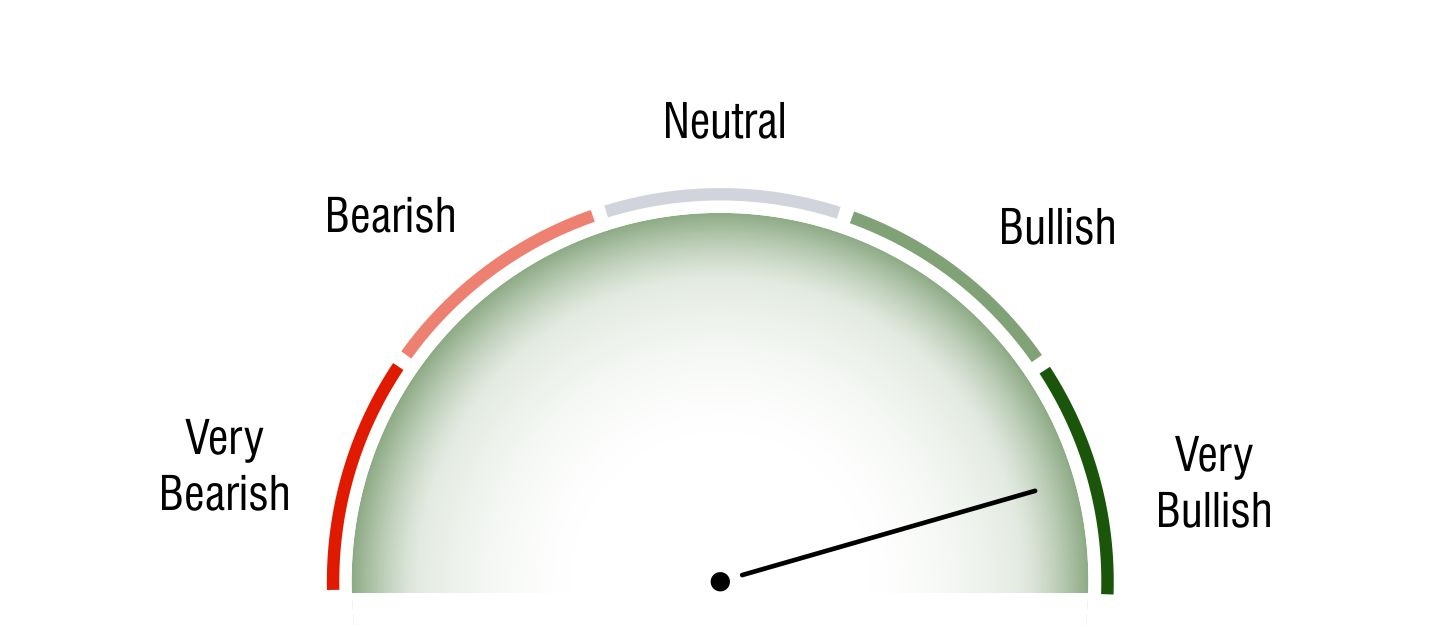

Technical Analysis

Short Term Investors

Very Bullish

Medium Term Investors

Very Bullish

Long Term Investors

Very Bullish

Moving Averages

5 DMA

Bullish

2188.38

10 DMA

Bullish

2133.31

20 DMA

Bullish

2133.97

50 DMA

Bullish

2024.11

100 DMA

Bullish

1914.37

200 DMA

Bullish

1857.77

Intraday Support and Resistance

(Based on Pivot Points) undefined | BSE : 2267.55

Updated On Apr 22, 2025 04:00 PM For Next Trading Session

| Pivots | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| R3 | 2355.16 | 2328.53 | 2284.34 | - | - |

| R2 | 2328.53 | 2306.95 | 2279.16 | 2327.73 | - |

| R1 | 2298.66 | 2293.61 | 2273.98 | 2297.06 | 2313.6 |

| P | 2272.03 | 2272.03 | 2272.03 | 2271.23 | 2279.5 |

| S1 | 2242.16 | 2250.45 | 2263.62 | 2240.56 | 2257.1 |

| S2 | 2215.53 | 2237.11 | 2258.44 | 2214.73 | - |

| S3 | 2185.66 | 2215.53 | 2253.26 | - | - |

Key Metrics

EPS

72.16

P/E

31.42

P/B

4.07

Dividend Yield

0.09%

Market Cap

4,51,088 Cr.

Face Value

5

Book Value

556.51

ROE

14.84%

EBITDA Growth

13,349.82 Cr.

Debt/Equity

0

Shareholding History

Quarterly Result (Figures in Rs. Crores)

Kotak Mahindra Bank Ltd Quaterly Results

| Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | ||

| INCOME | 24083.15 | 27907.33 | 28879.27 | 26880.02 | 23945.79 | |

| PROFIT | 4264.78 | 5337.2 | 4579.66 | 5044.05 | 4701.02 | |

| EPS | 21.46 | 26.66 | 37.47 | 25.37 | 23.64 |

Kotak Mahindra Bank Ltd Quaterly Results

| Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 | Dec 2024 | ||

| INCOME | 14096.04 | 15285.35 | 19195.05 | 15900.46 | 16050.38 | |

| PROFIT | 3005.01 | 4133.3 | 3565.58 | 3343.72 | 3304.8 | |

| EPS | 15.12 | 20.6 | 31.44 | 16.82 | 16.62 |

Profit & Loss (Figures in Rs. Crores)

Kotak Mahindra Bank Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 21471.09 | 28032.37 | 33983.77 | 38813.31 | 45979.11 | 50365.74 | 56407.51 | 58681.68 | 68142.03 | 94273.91 | |

| PROFIT | 3035.29 | 3455.73 | 4931.34 | 6169.42 | 7189.6 | 8571.56 | 9961.94 | 12069.62 | 14916.9 | 18207.83 | |

| EPS | 19.75 | 18.7 | 26.88 | 32.26 | 37.3 | 44.99 | 49.76 | 59.92 | 74.2 | 90.24 |

Kotak Mahindra Bank Ltd Profit & Loss

| Mar 2015 | Mar 2016 | Mar 2017 | Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | ||

| INCOME | 11748.32 | 18996.41 | 21176.09 | 23800.71 | 28547.23 | 32301.72 | 31846.78 | 33024.74 | 41333.9 | 56072.01 | |

| PROFIT | 1857.08 | 2087.77 | 3403.53 | 4054.26 | 4852.5 | 5926.62 | 6942.83 | 8555.01 | 10933.59 | 13779.27 | |

| EPS | 11.99 | 11.29 | 18.53 | 21.43 | 25.49 | 30.88 | 34.94 | 42.99 | 54.86 | 69.13 |

Balance Sheet (Figures in Rs. Crores)

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Capital | 993.96 | 1,493.28 | 1,492.33 | 1,490.92 | 1,456.52 | 1,454.38 | 952.82 | 920.45 | 917.19 | 386.18 |

| Reserves Total | 1,28,898.44 | 1,10,760.81 | 95,641.7 | 83,345.53 | 65,677.6 | 56,825.35 | 49,533.24 | 37,570.39 | 32,443.45 | 21,767.14 |

| Equity Application Money | 79.29 | 60.31 | 31.31 | 2.16 | 2.87 | 2.07 | 2.17 | 1.87 | 3.41 | 3 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 474.43 | 395.6 | 335.69 |

| Deposits | 4,45,268.76 | 3,61,272.62 | 3,10,086.89 | 2,78,871.41 | 2,60,400.21 | 2,24,824.26 | 1,91,235.8 | 1,55,540 | 1,35,948.76 | 72,843.46 |

| Borrowings | 75,105.61 | 57,033.92 | 55,159.87 | 47,738.9 | 65,576.72 | 66,438.94 | 58,603.97 | 49,689.91 | 43,729.79 | 31,414.88 |

| Other Liabilities & Provisions | 44,191.9 | 32,044.81 | 33,636.52 | 25,523.34 | 18,714.2 | 18,414.16 | 14,967.13 | 13,197.64 | 12,217.09 | 8,032.81 |

| Policy Holders Fund | 73,375.6 | 57,979.47 | 50,666.79 | 42,071.52 | 31,508.82 | 27,417.81 | 22,425.34 | 18,792.88 | 15,148.28 | 13,792.61 |

| TOTAL LIABILITIES | 7,67,913.56 | 6,20,645.22 | 5,46,715.41 | 4,79,043.78 | 4,43,336.94 | 3,95,376.97 | 3,37,720.47 | 2,76,187.57 | 2,40,803.57 | 1,48,575.77 |

| APPLICATION OF FUNDS : | ||||||||||

| Cash & Balances with RBI | 36,286.74 | 19,985.21 | 36,049.18 | 12,528 | 9,513.24 | 10,910.92 | 8,933.5 | 7,512.22 | 6,924.9 | 3,945.12 |

| Balances with Banks & money at Call | 28,919.65 | 22,940.14 | 16,616.31 | 35,188.62 | 54,566.61 | 20,353.54 | 15,467.13 | 18,076.32 | 4,674.51 | 2,958.33 |

| Investments | 2,46,445.72 | 1,95,337.97 | 1,64,529.41 | 1,56,945.55 | 1,11,196.91 | 1,03,487.02 | 90,976.6 | 68,461.54 | 70,273.9 | 45,588.89 |

| Advances | 4,30,351.58 | 3,59,107.46 | 3,04,473.6 | 2,52,169.75 | 2,49,878.96 | 2,43,461.99 | 2,05,997.32 | 1,67,124.91 | 1,44,792.82 | 88,632.21 |

| Fixed Assets | 3,510.26 | 3,074.96 | 2,723.38 | 2,553.92 | 2,674.72 | 2,697.46 | 2,542.89 | 1,758.62 | 1,761.02 | 1,384.97 |

| Other Assets | 22,399.6 | 20,199.49 | 22,323.54 | 19,657.93 | 15,506.49 | 14,466.04 | 13,803.03 | 13,253.94 | 12,376.44 | 6,066.25 |

| TOTAL ASSETS | 7,67,913.55 | 6,20,645.23 | 5,46,715.42 | 4,79,043.77 | 4,43,336.93 | 3,95,376.97 | 3,37,720.47 | 2,76,187.55 | 2,40,803.59 | 1,48,575.77 |

| Contingent Liabilities | 7,30,071.54 | 4,63,403.26 | 2,73,155.36 | 2,00,436.24 | 1,88,226.87 | 2,16,019.13 | 2,09,231.86 | 1,95,603.44 | 2,44,491.08 | 65,932.22 |

| Bills for collection | 47,467.71 | 44,655.24 | 38,709.28 | 41,272.8 | 39,518.98 | 31,852.23 | 24,255.31 | 20,318.26 | 14,964.05 | 4,419.99 |

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | |

| SOURCES OF FUNDS : | ||||||||||

| Capital | 993.96 | 1,493.28 | 1,492.33 | 1,490.92 | 1,456.52 | 1,454.38 | 952.82 | 920.45 | 917.19 | 386.18 |

| Reserves Total | 95,645.5 | 81,966.67 | 70,964.14 | 62,236.05 | 47,558.78 | 41,444 | 36,528.83 | 26,695.62 | 23,041.87 | 13,754.91 |

| Equity Application Money | 79.29 | 60.31 | 31.31 | 2.16 | 2.87 | 2.07 | 2.17 | 1.87 | 3.41 | 3 |

| Deposits | 4,48,953.75 | 3,63,096.05 | 3,11,684.11 | 2,80,100.05 | 2,62,820.52 | 2,25,880.36 | 1,92,643.27 | 1,57,425.86 | 1,38,643.02 | 75,759.56 |

| Borrowings | 28,368.1 | 23,416.27 | 25,967.12 | 23,650.65 | 37,993.31 | 32,248.29 | 25,154.15 | 21,095.48 | 20,975.34 | 11,250.46 |

| Other Liabilities & Provisions | 26,560.47 | 20,042.47 | 19,476.78 | 16,153.82 | 10,555.48 | 11,303.57 | 9,795.43 | 8,596.62 | 8,804.93 | 4,921.95 |

| Total Liabilities | 6,00,601.07 | 4,90,075.05 | 4,29,615.79 | 3,83,633.65 | 3,60,387.48 | 3,12,332.67 | 2,65,076.67 | 2,14,735.9 | 1,92,385.76 | 1,06,076.06 |

| APPLICATION OF FUNDS : | ||||||||||

| Cash & Balances with RBI | 36,252.04 | 19,965.56 | 36,026.23 | 12,493.61 | 9,505.05 | 10,877.53 | 8,908.5 | 7,492.42 | 6,903.43 | 3,928.3 |

| Balances with Banks & money at Call | 16,536.36 | 12,576.75 | 6,897.72 | 27,132.92 | 43,787.25 | 13,798.02 | 10,711.6 | 15,079.58 | 3,976.28 | 2,334.06 |

| Investments | 1,55,403.76 | 1,21,403.73 | 1,00,580.22 | 1,05,099.19 | 75,051.55 | 71,189.09 | 64,562.35 | 45,074.19 | 51,260.22 | 28,659.11 |

| Advances | 3,76,075.27 | 3,19,861.21 | 2,71,253.6 | 2,23,670.16 | 2,19,748.19 | 2,05,694.81 | 1,69,717.92 | 1,36,082.13 | 1,18,665.3 | 66,160.71 |

| Fixed Assets | 2,155.3 | 1,920.32 | 1,643.72 | 1,535.27 | 1,623.13 | 1,651.55 | 1,527.16 | 1,537.63 | 1,551.59 | 1,206.71 |

| Other Assets | 14,178.34 | 14,347.47 | 13,214.31 | 13,702.49 | 10,672.32 | 9,121.7 | 9,649.14 | 9,469.94 | 10,028.94 | 3,787.17 |

| Total Assets | 6,00,601.07 | 4,90,075.04 | 4,29,615.8 | 3,83,633.64 | 3,60,387.49 | 3,12,332.7 | 2,65,076.67 | 2,14,735.89 | 1,92,385.76 | 1,06,076.06 |

| Contingent Liabilities | 7,16,408.87 | 4,54,073.65 | 2,66,316.97 | 1,92,995.54 | 1,87,177.35 | 2,11,945.94 | 2,04,936.05 | 1,92,958.64 | 2,42,522.28 | 63,602.29 |

| Bills for collection | 47,467.71 | 44,655.24 | 38,709.28 | 41,272.8 | 39,518.98 | 31,852.23 | 24,255.31 | 20,318.26 | 14,964.05 | 4,419.99 |

Cash Flow (Figures in Rs. Crores)

| Net Profit before Tax and Extr... | 23,863.38 |

| Depreciation | 791.75 |

| P/L on Sales of Assets | -7.14 |

| P/L on Sales of Invest | -7,417.34 |

| Prov. and W/O (Net) | 2,288.82 |

| Others | -500 |

| Total Adjustments (PBT and Ext... | -4,343.9 |

| Operating Profit before Workin... | 19,519.48 |

| Loans and Advances | -70,818.64 |

| Investments | -36,326.75 |

| Change in Deposits | 83,996.14 |

| Total Adjustments (OP before W... | 2,203.11 |

| Cash Generated from/(used in) ... | 21,722.59 |

| Direct Taxes Paid | -6,037.59 |

| Total Adjustments(Cash Generat... | -6,037.59 |

| Cash Flow before Extraordinary... | 15,685 |

| Net Cash from Operating Activi... | 15,685 |

| Purchased of Fixed Assets | -1,126.69 |

| Sale of Fixed Assets | 34.61 |

| Purchase of Investments | -7,472.91 |

| Acquisition of Companies | -531.94 |

| Net Cash used in Investing Act... | -8,919.06 |

| Proceeds from Issue of shares ... | 199.23 |

| Proceed from 0ther Long Term B... | 16,152.49 |

| Dividend Paid | -336.62 |

| Net Cash used in Financing Act... | 15,515.11 |

| Net Profit before Tax and Extr... | 18,013.72 |

| Depreciation | 614.79 |

| Dividend Received | 308.9 |

| P/L on Sales of Assets | -3.03 |

| P/L on Sales of Invest | -1,481.78 |

| Prov. and W/O (Net) | 1,960.5 |

| Others | -500 |

| Total Adjustments (PBT and Ext... | 781.59 |

| Operating Profit before Workin... | 18,795.31 |

| Loans and Advances | -57,700.53 |

| Investments | -35,495.27 |

| Change in Deposits | 85,857.69 |

| Total Adjustments (OP before W... | -279.37 |

| Cash Generated from/(used in) ... | 18,515.94 |

| Direct Taxes Paid | -4,615.15 |

| Total Adjustments(Cash Generat... | -4,615.15 |

| Cash Flow before Extraordinary... | 13,900.79 |

| Net Cash from Operating Activi... | 13,900.79 |

| Purchased of Fixed Assets | -884.73 |

| Sale of Fixed Assets | 27.73 |

| Sale of Investments | 3,302.72 |

| Investment in Group Cos. | -733.12 |

| Net Cash used in Investing Act... | 2,030.87 |

| Proceeds from Issue of shares ... | 199.23 |

| Proceed from 0ther Long Term B... | 4,951.83 |

| Dividend Paid | -336.62 |

| Net Cash used in Financing Act... | 4,314.44 |

Company Details

Registered Office |

|

| Address | 27 BKC C-27 G-Block, Bandra Kurla Complex Bandra(E) |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400051 |

| Tel. No. | 91-22-61660001 |

| Fax. No. | 91-22-67132403 |

| investor.grievances@kotak.com | |

| Internet | http://www.kotak.com |

Registrars |

|

| Address | 27 BKC C-27 G-Block |

| City | Mumbai |

| State | Maharashtra |

| Pin Code | 400051 |

| Tel. No. | 91-22-61660001 |

| Fax. No. | 91-22-67132403 |

| investor.grievances@kotak.com | |

| Internet | http://www.kotak.com |

Management |

|

| Name | Designation |

| Uday Kotak | Non Executive Director |

| Uday Shankar | Independent Director |

| Avan Doomasia | Company Sec. & Compli. Officer |

| Ashok Gulati | Independent Director |

| Amit Desai | Non Executive Director |

| Ashu Suyash | Independent Director |

| SHANTI EKAMBARAM | Deputy Managing Director |

| Chandra Shekhar Rajan | Part Time Chairman |

| Ashok Vaswani | Managing Director & CEO |

| Eli Leenaars | Independent Director |

| Ketaki Bhagwati | Independent Director |

| Jaideep Hansraj | WTD & Additional Director |